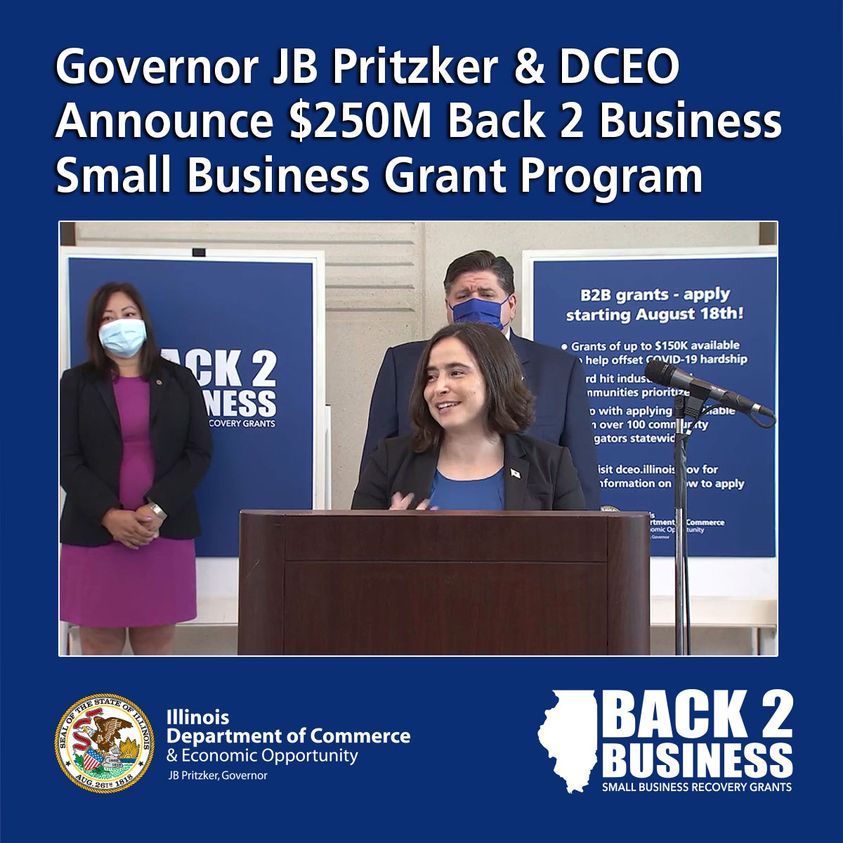

$250M Back to Business Grant Illinois – Requirement, Application & Deadline

August 18, 2021 – As part of Governor JB Pritzker’s overall economic recovery strategy, the $250 million (B2B) Back 2 Business grant Illinois program aims to deploy small businesses recovery grants for those hits hardest by the COVID-19 pandemic.

The Back 2 Business grant Illinois program builds on the success of last year’s Business Interruption Grant (BIG) program – equity focused business relief program, which directed $290 million to 9,000 businesses in 98 communities across Illinois.

Back to Business Grant Illinois program is a key component of the Governor’s $1.5 billion economic recovery plan, aimed toward a swift and equitable deployment of the American Recovery Plan Act (ARPA) funds that have been designated for Illinois to assist in recovery from the COVID pandemic.

To assist small businesses with the Back to Business Grant Illinois application process and other upcoming or ongoing economic recovery grant programs offered at the State or federal level.

DCEO has invested $9 million in support of Community Navigator organizations working in every region of the state.

These organizations will provide technical assistance to businesses, with a focus on underserved businesses including minority, rural, veteran, and women-owned businesses.

Back 2 Business Funding Available:

- $250 million to small businesses across the state that experienced losses in 2020 due to COVID-19, including the following set-asides.

- $100 million – Businesses located in Disproportionately Impacted Areas (DIAs). (See DIA Map below)

- $30 million – Arts and Entertainment businesses that didn’t receive Shuttered Venue Operators grants

- $25 million – Restaurants and taverns that didn’t receive the Restaurant Revitalization Fund

- $25 million – Hotels

- $25 million – Businesses that didn’t receive a BIG grant due to exhaustion of funds

- Grants will range from $5,000 to $150,000 per business and can be used to cover a wide range of operations/staff/overhead costs

- Up to $250,000 for hotels

Back 2 Business Eligibility Requirements:

- Businesses with revenues of $20 million or less in 2019 and a reduction in revenue in 2020 due to COVID-19 (35 million or less for hotels)

- Priority will be given to the following categories:

- Hard-hit industries (see eligibility guidelines for a full list of priority industries and their definitions)

- Hard-hit areas – DIAs comprising of 176 zip codes

- Businesses who have yet to qualify for state funding or federal assistance (including the Paycheck Protection Program (PPP), Restaurant Revitalization Fund (RRF), business Interruption Grant (BIG), Shuttered Venue Operators Grant (SVOG), and more)

- Businesses that had less than $5 million in revenue in 2019

Back to Business Grant Illinois Eligibility Guidelines

Businesses must meet the following requirements to be eligible for funds available through the Back to Business Grant Illinois program.

Note that this is a summary, and further terms that recipients must comply with are outlined in the Back to Business Grant Program Certifications and Requirements, found [here].

- Must be an independently owned and operated for-profit corporation or limited liability corporation, partnership, or sole proprietorship authorized to conduct business in the State of Illinois; or a nonprofit;

- Must have been operating during or before December 2019.

- Must have had less than $20 million in gross operating revenue in calendar year 2019, or a prorated amount if in operation for less than a year prior to December 2019.

- Must have experienced a loss in revenue of at least $5,000 in 2020 due to economic disruptions related to the COVID-19 pandemic.

- Must have had reduced operations due to government orders, public health guidelines, or depressed consumer demand during the COVID 19 pandemic.

- Must have complied with all relevant laws, regulations, and executive orders from the State and federal government, including the social distancing guidelines as promulgated by the Executive Orders of the Illinois Governor.

The following businesses are not eligible for back to business grant Illinois:

- Independent contractors or freelance workers that do not operate a sole proprietorship;

- Child care providers that have received and/or are registered for Child Care Restoration Grants;

- A private club or business that limits membership for reasons other than capacity;

- A business primarily engaged in speculative activities that develop profits from fluctuations in price rather than through normal course of trade;

- A business that earns more than a quarter of its annual net revenue from lending activities, unless the business is a non-bank or non-bank holding company certified as a Community Development Financial Institution (CDFI);

- A business that derives at least 33% of its gross annual revenue from legal gambling activities;

- A business engaged in pyramid sales, where a participant’s primary incentive is based on the sales made by an ever-increasing number of participants;

- A business engaged in activities that are prohibited by federal law or applicable law in the jurisdiction where the business is located or conducted. (Included in these activities is the production, servicing, or distribution of otherwise legal products that are to be used in connection with an illegal activity, such as selling drug paraphernalia or operating a motel that knowingly permits illegal prostitution);

- A business that derives a majority of its income as an owner of real property that leases that property to a tenant or tenants under a lease agreement;

- A business principally engaged in teaching, instructing, counseling, or indoctrinating religion or religious beliefs, whether in a religious or secular setting;

- A government-owned business entity (except for businesses owned or controlled by a Native American tribe);

- A business primarily engaged in political or lobbying activities;

- A business that manufactures or sells at wholesale, tobacco products, liquor or that manufactures or sells firearms at wholesale or retail;

- A night club or strip club;

- An employment agency;

- A pawn shop;

- A liquor store;

- A storage facility or trailer-storage yard or junk yard;

- An establishment similar to any enumerated above; or

- A business in which a majority owner has a financial or familial connection to a director, principal shareholder or leadership member of the Department or Department’s partner under the program.

How to apply for Back to Business Grant Illinois:

- Application Portal now open

- Applications can be tracked in real-time

- Allies for Community Business (A4CB), DCEO’s grant administrator, will began accepting applications on Wednesday, August 18, 2021

- Documentation needed:

- Business owner ID (ITIN business owners eligible)

- Business’s 2019 AND 2020 Federal tax returns

- Two (2) business bank statements – one from the period April through December 2020, and most recent statement

- Prepare for the application process early by learning about the information and documents required

- Application is also available in: Spanish, Polish, Chinese, Hindi, and Arabic (coming soon)

- List of Frequently Asked Questions

Back to Business Grants Illinois Application and Required Documents

This round of the Back to Business Grant Illinois Program will make $250 million available for businesses that experienced losses as a result of the COVID-19 pandemic.

DCEO, through its grant administrator Allies for Community Business (A4CB), will begin accepting applications on Wednesday, August 18, 2021.

Below is a list of the application questions and required documents to apply for the Back to Business Grant Illinois Program. This document is not an application. Please do not fill it out and return it to DCEO.

This document is designed to allow business owners time to review, assess their eligibility, and gather any documents needed to complete the application.

Asterisks represent required fields. On Wednesday, August 18, this document will be replaced with an online submission portal that will collect

applicant information and required documents.

Download the documents requirement list here

Need help? Application assistance and webinars

Over 100 community navigators providing 1:1 regional support service for small businesses. Find a community navigator with the B2B search tool.

- B2B Webinar: Friday | August 13 | 10:00AM

- B2B Webinar (español/Spanish): Friday | August 13 | 12:00PM

- B2B Webinar: Tuesday | August 17 | 3:00PM

- B2B Webinar: Thursday | August 19 | 11:00AM

About Growth Corp

Small Business Growth Corporation (Growth Corp) is a nonprofit, mission-based lender dedicated exclusively to connecting small businesses with quality expansion capital through the administration of the SBA 504 Loan Program.

With a commitment to economic development, job creation, and the small business sector, Growth Corp is ranked a Top 10 National CDC for SBA 504 loan volume and is Illinois’ largest 504 loan provider.

In fact, Growth Corp’s substantial portfolio ($740+ million) is particularly impressive because every dollar was utilized by Midwest entrepreneurs to open and expand their small businesses. Contact any member of our lending team today!