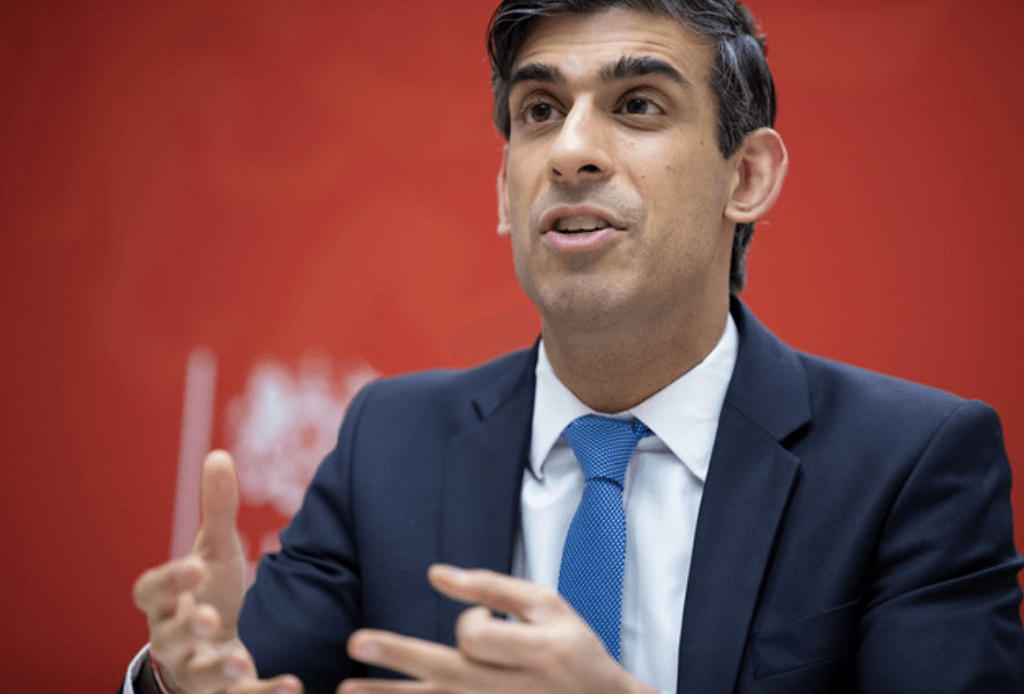

Sunak Planning Cuts to Income Tax and VAT

Chancellor Rishi Sunak is preparing tax cuts ahead of the next general election, according to Westminster sources.

Mr Sunak is said to be drawing up plans to shave 2p in the pound off income tax and possibly scrap the 45p rate.

Under the proposals, reported by The Times, basic rate payers would be up to £750 better off each year.

Households and thousands of small businesses using green energy could benefit from a cut in VAT.

The Treasury is also said to be working on plans to increase the threshold for inheritance tax. The figure has been frozen since 2009, with 22,800 estates paying 40% on anything above that, the report adds.

Mr Sunak’s preference is said to be for a series of income tax cuts before 2024, when the next general election is expected.

Any cuts would have implications for the Scottish government which has the power to set a different rate of income tax.

A Treasury spokesperson told the Reuters news agency, “We have been clear that we want to see taxes going down by the end of this Parliament and keep the tax system under review. We do not comment on speculation about specific tax change.”

Mr Sunak said in October that he had to raise taxes to help pay for the cost of propping up the economy during the COVID-19 crisis, but his preference is to cut taxes.